What is trading?

Trading involves buying and selling financial assets to profit from price fluctuations. Unlike long-term investing, which focuses on gradual wealth accumulation, trading aims to capitalize on short- to medium-term price movements.

For example, suppose you buy a stock at $50, anticipating a price increase. If the stock price rises to $60, selling it would yield a $10 profit per share. Conversely, if the price drops to $40, you would incur a $10 loss per share.

How does trade happen?

Trading occurs through financial exchanges where buyers and sellers come together to transact. Modern trading typically takes place on electronic platforms provided by brokers who act as intermediaries. When you place a trade, your order is sent to the exchange's order book, where it's matched with a counterparty—someone willing to take the opposite side of your trade.

For example, when you want to buy shares of a company, your buy order is matched with someone willing to sell those shares. The transaction happens at an agreed price, which is influenced by current supply and demand in the market. In highly liquid markets, trades are executed almost instantly because there are many participants ready to buy or sell at any given moment.

It's important to understand that for every buyer in the market, there must be a seller, and vice versa. This continuous interaction between buyers and sellers is what creates price movements in financial markets. When more people want to buy than sell, prices tend to rise. Conversely, when more people want to sell than buy, prices typically fall.

Here are the key aspects:

Speculation: Traders make predictions about whether the price of an asset will rise or fall within a given timeframe. They use various strategies and analysis techniques to time their trades effectively.

Liquidity: Markets like forex and stocks provide high liquidity, meaning assets can be bought and sold quickly, allowing traders to enter and exit positions easily without significantly affecting the market price.

Volatility: Price fluctuations create trading opportunities. More volatile markets offer greater profit potential but also come with increased risk.

Investing vs. trading

Many beginners confuse trading with investing, but they have different objectives and approaches.

Buy and sell trades

Every trade in the financial markets involves two essential actions: buying and selling. The sequence of these actions determines whether a trader is taking a long or short position in the market. Understanding this fundamental concept is crucial for developing effective trading strategies.

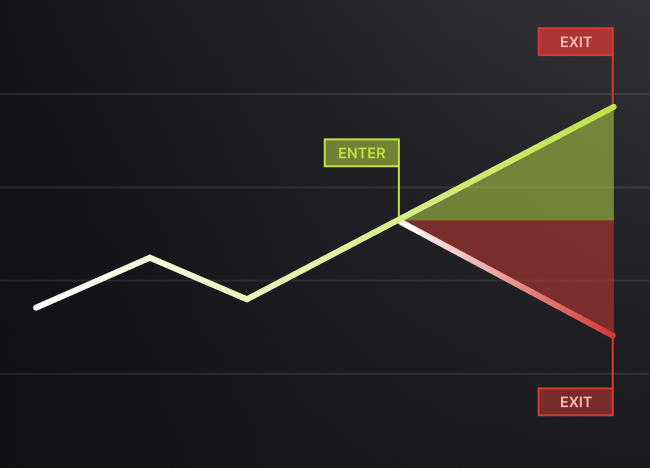

Going long (buy first)

When a trader executes a buy-first strategy, they are taking what's known as a "long position." This is the most intuitive approach to trading and aligns with the traditional investment mindset of "buy low, sell high."

The process works as follows:

- The trader purchases an asset at the current market price (or places a limit order to buy at a specific price).

- They hold the asset while monitoring market conditions and price movements.

- If the price increases as anticipated, they sell the asset at the higher price, capturing the difference as profit.

- If the price moves against them (decreases), they may choose to sell at a loss or continue holding, depending on their analysis and risk management rules.

For example, a trader might buy 100 shares of Company XYZ at $50 per share, investing $5,000. If the price rises to $55, selling those shares would yield a $500 profit (minus transaction costs). However, if the price falls to $45, selling would result in a $500 loss.

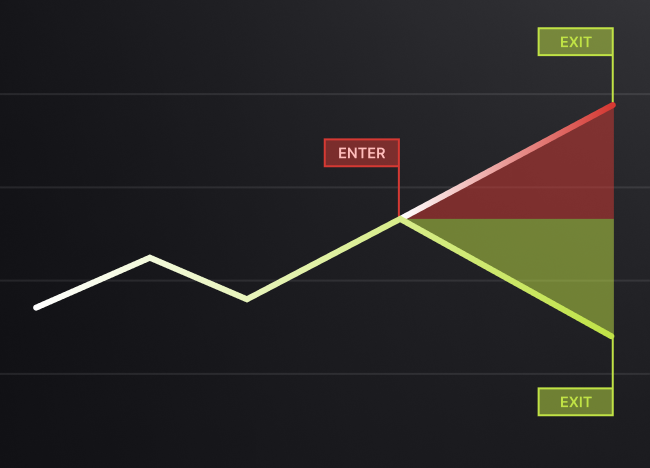

Going short (sell first)

A sell-first strategy, or "short position," is a more advanced trading technique that allows traders to profit from falling markets. This approach inverts the traditional model, following a "sell high, buy low" methodology.

The short-selling process involves:

- The trader borrows shares from their broker (usually happening behind the scenes from the trader's perspective).

- They immediately sell these borrowed shares at the current market price.

- If the price decreases as expected, they buy back the same number of shares at the lower price.

- The borrowed shares are returned to the broker, and the trader keeps the difference between the selling and buying prices as profit.

For instance, a trader might short sell 100 shares of Company ABC at $80 per share, receiving $8,000. If the price drops to $70, they can buy back those 100 shares for $7,000, making a $1,000 profit (minus borrowing fees and transaction costs). However, if the price rises to $90, buying back would cost $9,000, resulting in a $1,000 loss.

Short selling carries additional risks compared to long positions. While losses on long positions are limited (a stock can only fall to zero), losses on short positions are theoretically unlimited, as a stock's price could rise indefinitely. Additionally, short sellers may face recall risk (when the lender demands the borrowed shares back) and must pay any dividends issued while they hold the short position.

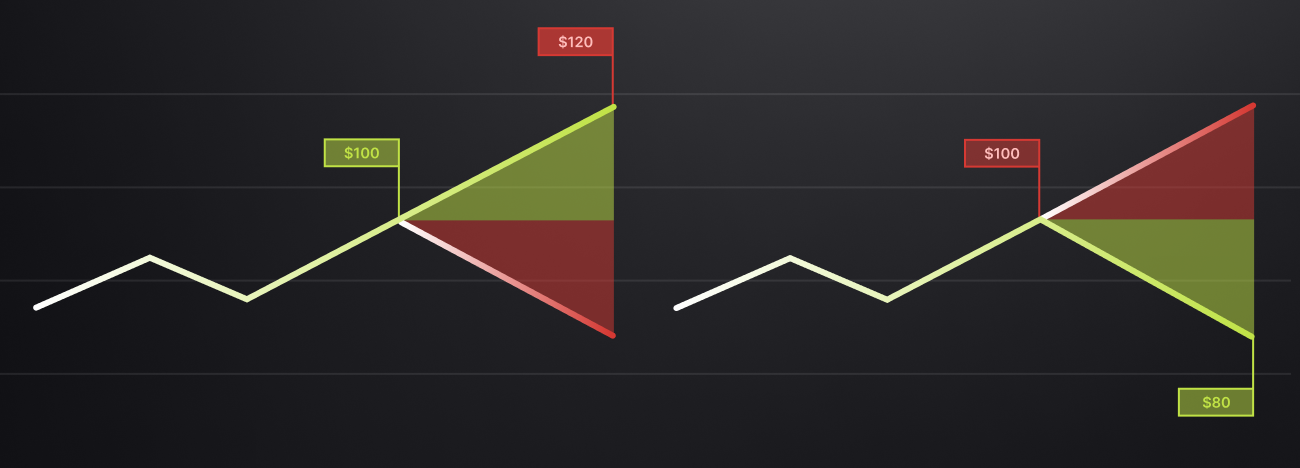

Let’s look at these examples:

- A trader “A” goes long on a stock at $100. If the stock price rises to $120, they make a $20 profit per share. Going long means buying a stock with the expectation that its price will increase.

- A trader “B” goes short on a stock at $100. If the price drops to $80, they buy it back at the lower price and make a $20 profit per share. Going short means selling a stock first, expecting its price to decline, and then buying it back at a lower price to make a profit.

Types of trading timeframes:

Different trading styles are defined primarily by how long positions are held. Each style has unique characteristics, advantages, and challenges:

The style you choose should align with your personality, schedule, and financial goals. Many beginners find swing trading offers a good balance between time commitment and opportunity, while more experienced traders might use multiple styles depending on market conditions and available opportunities.

What trading involves

Successful trading requires more than just buying and selling; it involves continuous learning, skill development, and discipline.

Essential components of trading:

Market Analysis:

Traders study price charts, news, and economic indicators to identify potential trading opportunities. There are two main approaches:

- Technical Analysis: Uses historical price movements, chart patterns, and indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to predict future price action. Technical analysts believe that "price action discounts everything" and that historical patterns tend to repeat.

- Fundamental Analysis: Examines economic reports, company earnings, interest rates, and global events to determine the true value of an asset. Fundamental traders look for assets that are undervalued or overvalued compared to their "intrinsic value."

Leverage vs. non-leverage trading:

Leverage trading allows traders to borrow money from a broker to increase their position size, meaning they can control a larger trade with a smaller amount of their own money.

For example, with 10:1 leverage, a trader who has $1,000 can take a position worth $10,000. This can lead to much larger profits compared to trading with only personal funds, but it also increases risk significantly. If the market moves against the trader, losses are multiplied just as much as the gains.

Because of this, leverage should be used carefully, especially by beginners who are still learning how to manage risk. It is essential to understand that while leverage can enhance earnings, it can also wipe out an account quickly if not managed properly.

Non-leverage trading, on the other hand, means using only the money you actually own without borrowing from a broker. This limits the amount of profit a trader can make on a single trade, but it also greatly reduces risk.

A trader who only uses their own capital will never owe more than they initially invested. This is why non-leverage trading is often recommended for beginners, as it allows them to learn market movements and develop a strong risk management strategy before taking on additional financial exposure.

While the profit potential may be lower compared to leveraged trading, the controlled risk helps traders build confidence and experience without the pressure of magnified losses.

.png)

Key Takeaways

- Trading is the act of buying and selling assets for profit within short- to medium-term timeframes.

- Trading differs from investing in terms of time horizon, objectives, and approach.

- Every trade involves both buying and selling actions, with the sequence determining whether it's a long or short position.

- Various trading timeframes exist, from seconds (scalping) to months (position trading), each with unique characteristics.

- Leverage can amplify both profits and losses, making proper risk management essential.

Next Steps

After mastering these fundamentals, you'll be ready to explore specific markets and trading strategies in more detail. The next lesson will cover basic technical analysis and how to read price charts effectively.